How Algorand change the current banking and finance landscape

Banks often acts as a middlemen within the global market by managing and coordinating the financial system via their internal ledgers. As the Blockchain technology has sparked intense debate in recent years. In the financial industry, this debate has centered almost exclusively on the rise, and more recently on the relative decline, of cryptocurrencies and the risks of these instruments. However, blockchain technology has far wider implications for markets and banks. To get in front of emerging challenges, Algorand Blockchain provides an open, public, permission less and secure blockchain-based platforms that uses pure proof-of-stake and pseudorandom functions including for trade finanace. Many have called this project “Blockchain 3.0” as it solves Bitcoin’s well-known scalability problems whilst maintaining security and decentralization. Algorand stands out from other high performance blockchain by the credibility of its founder, MIT professor Silvio Micali.

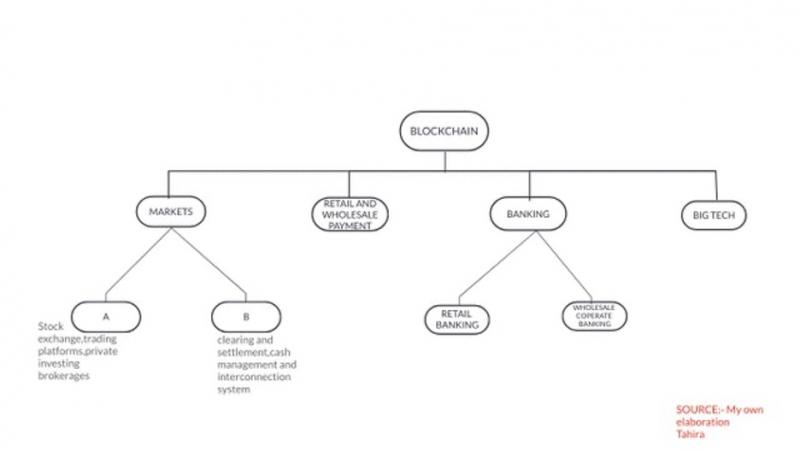

Potential use of block chain in Banking:

To illustrate, in the above diagram, there is a range of possible applications for blockchain in banking and finance. In the markets, blockchain can make equity trades faster and more secure, paving the way for more open and competitive trading. It could also make it easier to verify private investments and provide access to more potential suppliers. It too enables the development of more secure or complementary asset clearance, settlement and custody systems. Paradoxically, blockchain could even make it possible to manage and account for something as electronic as cash more efficiently, enhancing traceability and ownership record keeping.

In banking, there are broad possibilities in both the retail and wholesale segments. Beyond the realm of trade finance, there is scope for using distributed ledgers to improve efficiency, turnaround times and verification in areas such as:

• Real-time lending underpinned by borrower risk management based on smart contracts

• Property valuations and verification

• Development of tailored personal financial tools

• Management of liquidity and cash, virtual portfolios and management of currencies/remittances

• Audit and control of counterparty risk

• Mitigation of operational risk

• Regulatory compliance

Imparities of the Banking System:

The traditional finance market is centralized. Central authorities issue the regular currency that drives our economy and used for every trade like the financial markets and banks. Therefore, the power to manage and regulate the flow and supply of such currencies in the market resides to them. We also pass the control of our assets to various financial organizations like banks in expectations of getting higher returns. The problem with this is since all the control and fund is centralized, the risk is also at the center. These are the challenges that have impaired the banking system, rendering it irrelevant in the global financial system

• Slow Seed Of Transactions

• Cross-Border Restrictions

• Excessive Transaction Charges

• Absence Of Transparency

• Time consuming process

What are the main benefits of Algorand Blockchain for banking and finance?

Security:

Algorand pure proof-of-stake based blockchain architecture eliminates single point of failure and reduces the need to place data in the hands of intermediaries. It is worth considering, ideal for applications that require sovereign grade security and deal with confidential data. Anything in the realm of financial services would likely require the highest degree of security.

Transparency:

This blockchain network standardizes shared processes, and create a single shared source of truth for all network participants. That allows trade finance participants to provide a higher level of transparency through a shared ledger that accurately tracks goods moving around the globe. This is the first blockchain network provide immediate transaction finality with no forking.

Programmability :

Algorand blockchain allows the reliable automation of business process through the creation of assets on ASA and execution on smart contract at Layer-1. The ASA provides opportunities for local businesses to form cooperative and issue digital assets on the Algorand protocol allowing anyone to buy these assets and co-own the business. By issuing assets on the Algorand network, assets become transferable with a very high level of control by all parties.

Privacy

Privacy technology enabled by Algorand allows selective sharing of data between businesses. The confidential data that is name, addresses, contact details, email etc. will not be passed on to third parties without your permission or without being required by law of our privacy policy.

Trust:

One of the main challenge that faces banks is cyber-attack and money laundering, this is possible because bank ledgers are created within a centralized database which is more susceptible to hacks and cyber-attacks. Algorand is a truly decentralized, new, and secure way to manage a shared ledger that make it easier for different parties to collaborate and come to agreements which eliminates the risk level of money laundering by providing an inclusive, transparent, and secure system for its global users, and making it totally free of these types of hacks and break in.

Know your customer minimal time taking process:

Know your customer processes is very lengthy and time taking process in banking sector because banks are not allowed to finalized the transaction unless the whole kyc process will be completed and after the completion of the process, this process needs to be verified by the higher authority. If banks adopted Algorand networking properly, this will be minimize the wasting of time and delaying in transaction, While Algorand blockchain can store KYC records on its blockchain through which customer’s ID, addresses and documents can be independently checked and verified.

Faster execution of transaction:

The use of Algorand decentralized channel transactions are executed within seconds and the banks will be able to cut down the need for verification from third parties, therefore speeding up the time required for transferring funds. Algorand system has the ability to execute up to 1000 transactions in every second and the time frame for processing a particular payment is just 5 seconds, so the ability to finalize blocks, eliminates the need for high transactions charge. Algorand users enjoy low cost of operations and less time consumption process of transaction.

Quick settlement of funds using Algorand blockchain:

Sending money in the current banking system can be a lengthy process, can come with various fees for both banks and customers, and might require additional verification from headquarter and administration. In the age of instant connectivity, the legacy banking system hasn’t keep up with the rest of the technology developments.

A scalable Algorand blockchain technology provides a faster method of payment with lower fees that is available round the clock, without borders, and the same security guarantees that the legacy system can offer.

Minimize the High cost of loans:

Banks allows the customers to offer loans at relatively high interest rates, and restrict access to capital based on credit scores. This makes the borrowing process lengthy and expensive. While the economy depends on banks that is providing the necessary funds at highest cost items. Algorand allows anyone in the world to participate in a new type of lending ecosystem, which is part of the movement often referred to as Decentralized Finance (DeFi).To create more accessible financial system,DeFi aims to pull all financial application on top of this network. Peer-to-peer money lending, enabled by Algorand, allows anyone to borrow and lend money in a simple, secure and inexpensive way with no arbitrary restrictions. And thanks to Algorand Network the importance of its capability to lend digital assets can be widely adopted globally.

Assets tokenization on Algorand blockchain:

Buying and selling securities and other assets such as stocks, bonds commodities, currencies, and derivatives requires a complex, coordinated effort between banks, brokers and exchange. This process not only has to be efficient, but is also needs to be accurate. Added complexity directly correspond with increased time and cost. ASA is very popular source on Algorand for Asset tokenization. It would also open up new avenues for investors with limited capital by enabling them to buy frictional ownership of expensive assets investment products that might have unavailable to them previously. In the Algorand DeFi system you are the custodian of your own funds and assets.

Disintermediation:

Peer-to-peer exchange of information and value lets us remove intermediaries, enabling more structurally efficient economies. As adoption of Algorand protocol, removing financial service intermediaries (cut off the middle-man) who receive a fee for money transfer, foreign exchange transactions, transaction clearing and escrow services — can reduce friction and costs.

Resilience:

Because Algorand is an open, public, permission less and decentralized blockchain. Decentralized databases are shared by many market participants, they aren’t, t susceptible to central points of failure. On contrary, the most reliable centralized networks, such as banking sectors, suffer downtime from time to time. Most of the user’s faces the link down error when it’s urgent to transfer their assets or some business transactional process.

Is Algorand safe and wise choice for banking sector?

Safe is often a tricky word when it comes to digital matters with every security measure bound to find an equally and opposite force to test the robustness of the system or application.

Black market activities and money laundering schemes are the counterproductive side to the fluctuation safe currency and integrity laced transaction system based on trust and honor. Of course in this age nothing can be deemed perfectly safe. Thus Algorand is also called by a “Game changer” because they wins the trust of their user’s by providing a system to communicate identity, suitability and relevance of a transaction's details marks it out as a safe option for banks, and other sensitive information storage organizations. It has caught the eye of a lot of industries and this is because of the security it offers along with its trust and robustness as a system.

Final thought :

Although the financial industry is thrilled about blockchain, the technology will take a few years to become a mainstream financial model. That means that disruption will happen gradually – but surely. In the meantime banks have the time to prepare and adjust so that they can have a “second live” in a blockchain world. The banking and financial industry is one of the major sector that is going to be impacted by Algorand Blockchain. The potential use cases are plenty from real time transaction to tokenizing assets, lending, smoother international and domestic trade, more digitalized and quick process and many more.

Algorand blockchain network has the potential to disrupt not only the world’s currency market but also in the banking industry as a whole by cutting out these middlemen and replacing with a trustless ,borderless, transparent, open and scalable system that is easy to access everyone. AS a banker, I strongly believe that, Algorand will potentially help facilitate faster and cheaper transactions, increase access to capital, create higher data security, enforce trustless agreements through smart contracts, make compliance smoother and many more, once banks adopts Algorand Blockchain.

Written By Tahira Siddiqui

Follow us on twitter : https://twitter.com/Algorand

Website : https://www.algorand.com/

Previous Posts: